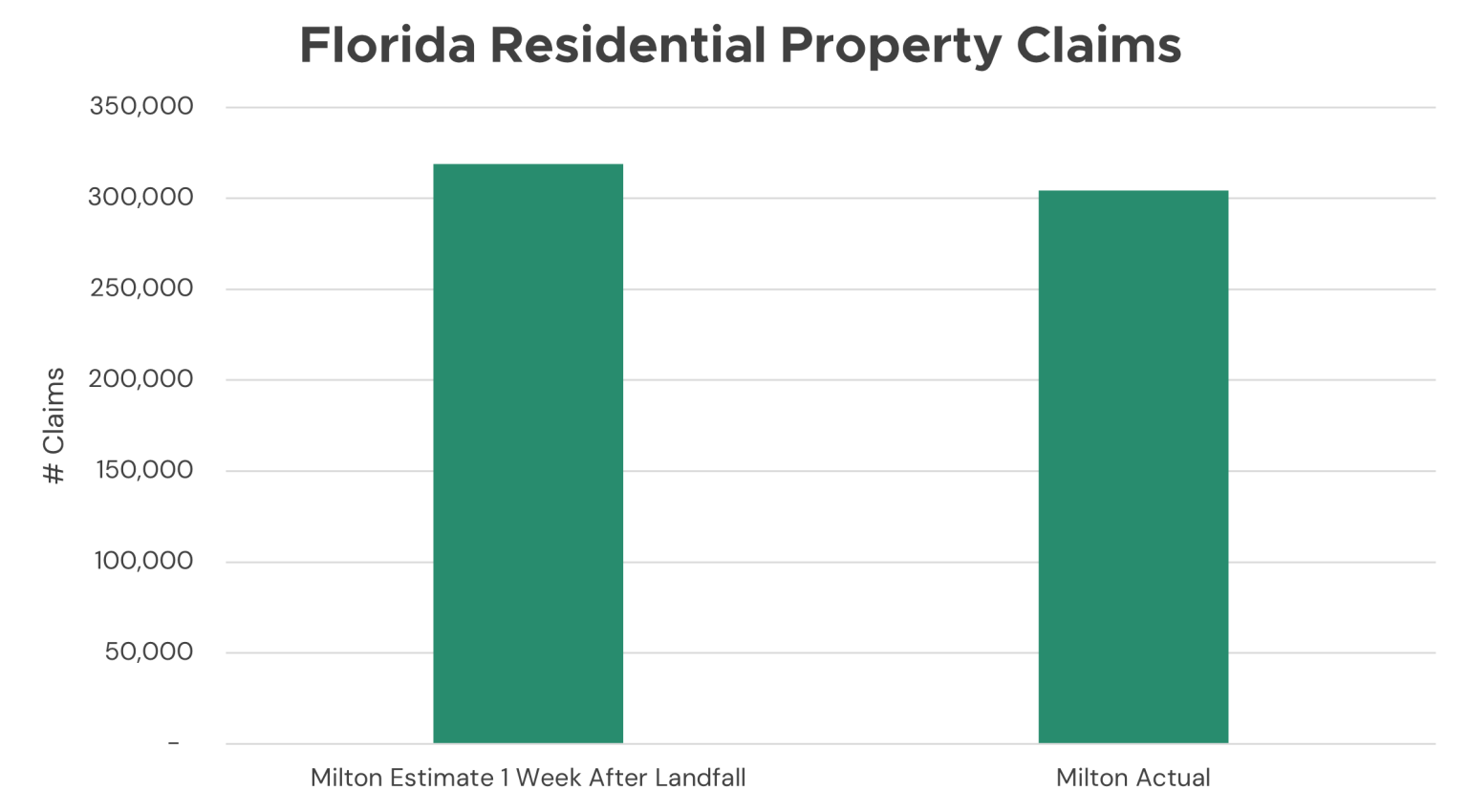

Final Milton Claims within 5% of Juniper Re’s 1 Week Post Landfall Estimate

Hurricane Milton made landfall near Siesta Key, FL as a Category 3 hurricane on October 9th, 2024. Leveraging Hurricane Ian claims development, Juniper Re estimated that the ultimate residential claim count for Milton would be about 319K claims one week after Milton made landfall.

According to the Florida Office of Insurance Regulation (OIR), residential property claims from Hurricane Milton were 304K, 4.6% below the estimate we made only one week after the event. Considering the legislative reforms in Florida and the fact that Hurricane Ian operated off a two-year claim reporting deadline compared to one year for Hurricane Milton, the slight overestimate is not surprising.

As carriers receive claims, having an accurate ultimate claims estimate is key for reserve estimates. Leveraging both Hurricanes Milton and Ian can allow for a more robust estimate of claims development for future events. For the many new entrants to the Florida market that lack experience, this is key. For carriers that experienced these two events, they can use this information to compare their actual claims development to highlight their performance to the market or identify if they are underperforming.

The chart above shows the percentage of residential claims reported from Hurricanes Milton and Ian by week post landfall relative to the final total. There is good alignment in the timeline between the reporting of claims and the ultimate total. 46% of claims were reported within the first week after Hurricane Milton (44% for Ian). By the second week, that number reached 63% (same as Ian). 82% of the claims were reported at nine weeks post event (80% for Ian).

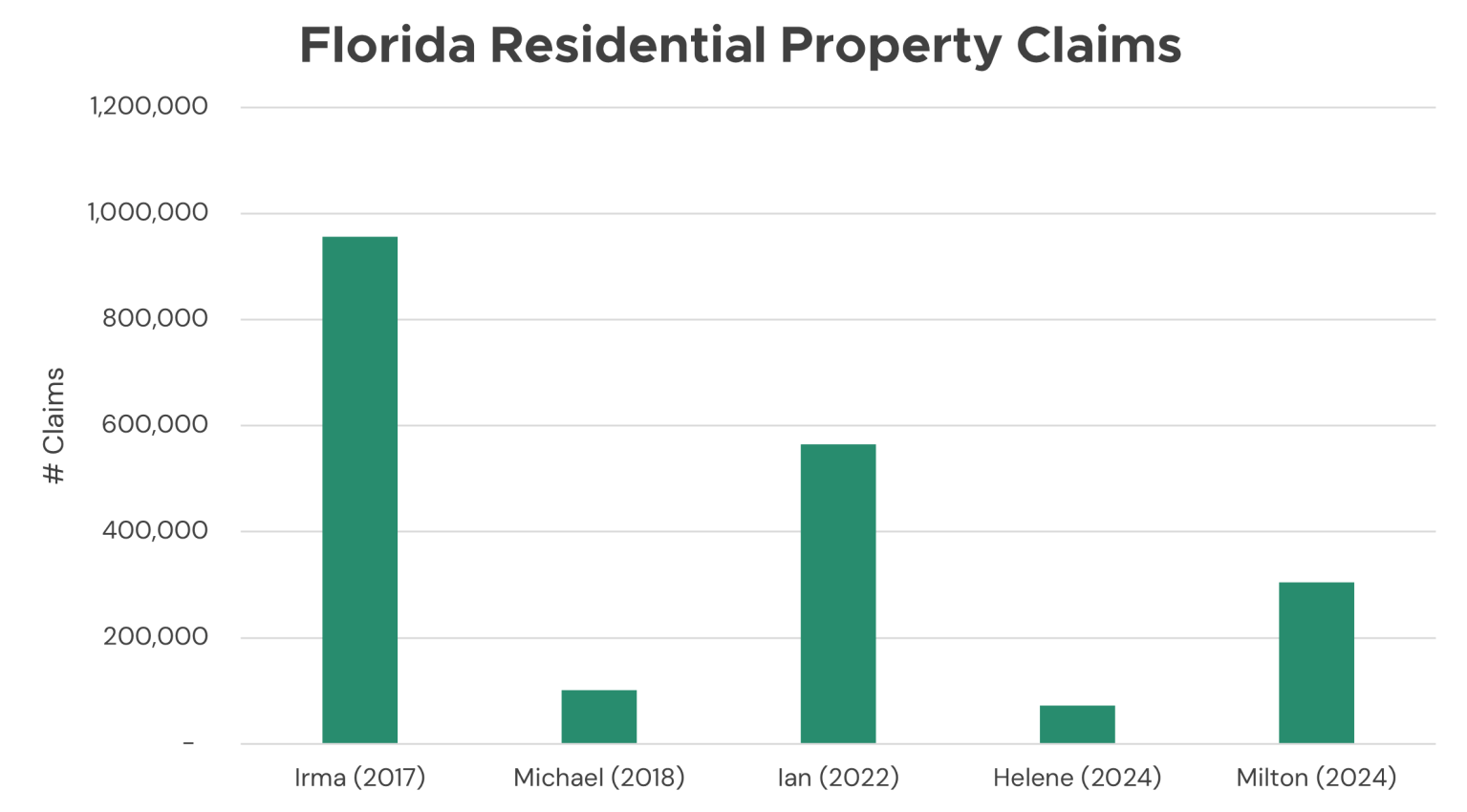

Hurricane Milton’s residential property claim count of 304K puts it as the 3rd highest Florida claim count event since the OIR started tracking in 2016. Milton is less than one-third of the claims from Hurricane Irma (2017). Amazingly, the 956K claims from Irma are more than Ian, Helene, and Milton combined (942K claims)

Claims handling can have a large impact on ultimate losses. Working with a trusted advisor allows carriers to reflect on their performance and plan for future events.

Notes:

- Insurers are required to submit claims information to the Florida Office of Insurance Regulation (OIR) which are then published on an industry-wide basis by line of business and county on the OIR website. Claims data calls are required frequently shortly after an event and gradually decrease over time. This analysis relies on data as reported to the OIR. It is not audited and is subject to errors.

- Ian final claims figure as of 3/24/25. Claims figure used to project Milton was as of 4/22/24. Milton claims figure as of 12/9/25.

Contact Information

Adam Miron

Head of Catastrophe Analytics, Juniper Re

763.350.8292

JUNIPER RE PRESS

Amy Money, Head of Marketing

Juniper Re

214.533.3837